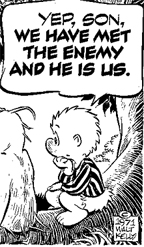

It really is all about union busting for righties. Yesterday the UAW refused to agree to steep wage cuts for auto workers, so Senate Republicans killed the Big Three bailout package.

Congressional Republicans have been in open revolt against Bush over the auto bailout. Senate Minority Leader Mitch McConnell of Kentucky joined other GOP lawmakers Thursday in announcing his opposition to the White House-backed bill, which passed the House on Wednesday. He and other Republicans insisted that the carmakers restructure their debt and bring wages and benefits in line with those paid by Toyota, Honda and Nissan in the United States.

Here’s the catch — wages, although not benefits, for Toyota workers in Kentucky are somewhat higher than wages paid to Michigan auto workers.

Hourly wages for UAW workers at GM factories are about equal to those paid by Toyota Motor Corp. at its older U.S. factories, according to the companies. GM says the average UAW laborer makes $29.78 per hour, while Toyota says it pays about $30 per hour.

The Big Three have bigger benefit costs, but not all because GM workers get “gold-plated” health care. It’s because the old U.S. automakers have huge numbers of retirees drawing pensions and benefits, while Toyota of Kentucky does not.

GM says its total hourly labor costs are now $69, including wages, pensions and health care for active workers, plus the pension and health care costs of more than 432,000 retirees and spouses. Toyota says its total costs are around $48. The Japanese automaker has far fewer retirees and its pension and health care benefits are not as rich as those paid to UAW workers.

The point is that wages are not the problem. Yet the Republican senators who stopped the bailout package wanted to cut wages.

One of the compromises being floated around yesterday was for American automaker workers to accept the same wages and benefits that non-union employees get in the South, effectively making unions irrelevant.

But let’s not kid ourselves that Toyota would willingly pay $30 an hour if GM were not paying about the same. Even if Kentucky workers are not unionized, they benefit from the fact that unions exist.

Righties hate unions so much that Little Lulu and others are talking about the UAW bailout, not the automakers’ bailout.

Remember when John McCain got all misty-eyed talking about wonderful American workers and how they were the backbone of our economy? The truth is that McCain and other Republicans in Washington love workers as much as they love dog poop on their shoes. Workers are cost. Workers want to get paid a living wage, and they want health care, and it cuts into profits. Your average Republican looks at a worker and sees money taken out of his quarterly stock dividend.

Although Japanese and other foreign cars are more marketable than what the Big Three have produced in recent years, the fact is that without massive government subsidies Toyota and other foreign manufacturers wouldn’t be building plants here. Further, if nothing is done about our health care “system,” eventually the foreign manufacturers like Toyota in Kentucky will be in the same boat the Big Three are in now.

See also Steve Benen.

What people are talking about:

What people are talking about: