The IRS has admitted that the average tax refund has shrunk by nearly 17 percent this year. This is for the early filers, of course, and the early filers tend to be people who usually get big refunds. Now there are lots of news stories about lots of people who were shocked at their tax bills; see, for example, Denver Woman Surprised With $8,000 Tax Bill After Expecting Refund.

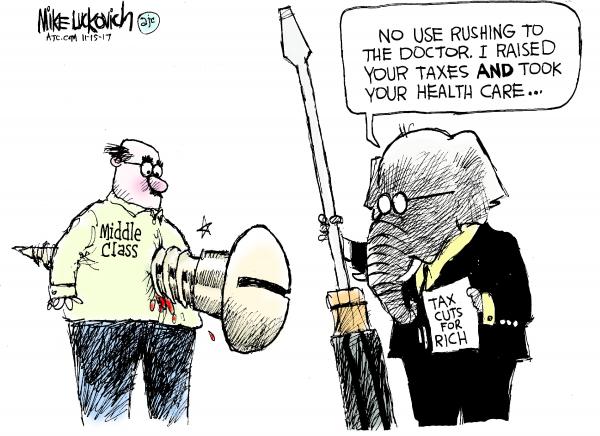

This has left Republicans scrambling to explain why their glorious tax cuts are leaving people with bigger tax bills.

With headlines blaring about smaller refunds in the first weeks of the three-month filing season, GOP lawmakers and their supporters are working in tandem to remind people that the GOP tax overhaul cut almost everyone’s taxes last year, regardless of what their tax refunds look like this year.

Typically, Republicans are falling back on blaming the victim — people who owe money didn’t withhold enough. Democrats have accused theTrump IRS of deliberately miscalculating withholding to give people more take-home pay and the illusion of a larger tax cut. This was supposed to help Republicans win the midterms, remember. But never fear — Banks made record profits last year thanks to the Republican tax cuts.

At least, maybe it’ll be harder for Republicans to sell tax cuts as the cure for all ills going forward. We’ll see.

Elsewhere — Paul Manafort could get as much as 22 years in prison, according to a court filing unsealed today. He’ll be sentenced next month.

" At least, maybe it’ll be harder for Republicans to sell tax cuts as the cure for all ills going forward "

Your joking right? Repugs have been selling "tax cuts" (actually redistribution of the tax burden to the middle class and working poor) for all of eternity. It's really the only card they have to play, besides misogyny, xenophobia, racism and fear! The dullards always buy into the "tax cut" con.

As horrible as the tax bill is, and it will get worse over time, emphasizing the lower refunds isn't really an accurate gauge of its cost to taxpayers. In many instances those lower refunds were coupled with lower paycheck deductions which left the money in taxpayers hands. If I remember this correctly the bill was crafted to give what looked like a tax break to average taxpayers in the first couple of years but post-2020 those taxes start to rise again and wind up higher later on than they had been prior to the bills' passage. And yes, the vast majority of the cuts went to the wealthiest and corporations.

But focusing on the lower refunds is not an accurate reflection of the true nature of the tax cuts this time around, and conservatives are pouncing on that misrepresentation big time. We need to look closely at the entire context of situations like this before grasping the easy message that may in fact be inaccurate.

As horrible as the tax bill is, and it will get worse over time, emphasizing the lower refunds isn't really an accurate gauge of its cost to taxpayers. In many instances those lower refunds were coupled with lower paycheck deductions which left the money in taxpayers hands. If I remember this correctly the bill was crafted to give what looked like a tax break to average taxpayers in the first couple of years but post-2020 those taxes start to rise again and wind up higher later on than they had been prior to the bills' passage. And yes, the vast majority of the cuts went to the wealthiest and corporations.

But focusing on the lower refunds is not an accurate reflection of the true nature of the tax cuts this time around, and conservatives are pouncing on that misrepresentation big time. We need to look closely at the entire context of situations like this before grasping the easy message that may in fact be inaccurate.

Tom,

I think you just blew your own "cover" as "Anonymous!"

But I promise I won't tell anyone. ?

Anonymous,

i think you just blew your "cover" as "Tom Elliot!"

I promise I won't tell anyone. ?

That was just a case of clicking too soon and then fixing it.

Two things:

1. I just accidentally gave myself a "thumbs-up" when I meant to hit "reply." I wish I could give myself a "middle finger" salute, to make amends.

2. My 'happy, smiling angel face' emoticon turned into a question mark. Why? (That's a real question mark, btw).

Let me try it again:

Here's a question mark: ?

Here's an attempt to leave said same emoticon: ?

“But focusing on the lower refunds is not an accurate reflection of the true nature of the tax cuts this time around, and conservatives are pouncing on that misrepresentation big time.” The post wasn’t intending to comment on the true nature of the tax cuts, just the political fallout from them. I’ve written about the substance in the past, such as in this post from 2017. Now I’m hoping the most recent bill is unpopular enough that Republicans will think twice about continuing to push for tax cuts.

How can this be a surprise to anyone?

The non-tRUMPian MSM made it very clear what was going on, and how it would adversly affect middle and lower class people.

Remember the words of former Republican advisor, Rick Wilson: "Everything tRUMP touches dies."

And here's what every American needs to keep in mind when conservatives tout some new tax cuts that will (solely) benefit the rich, but by having more money, some of that moolah will rain down on the poors:

The only two sure things that trickle down, are pee and poop!

Money?

NEVER!!!!!

" The only two sure things that trickle down, are pee and poop! "

https://www.youtube.com/watch?v=KjmjqlOPd6A

What do Trumpettes expect. You vote for a con artist you get conned. You get the illusion of a tax cut and end up paying more. I am certainly preaching to the wrong choir here, as readers at this site did not fall for this trickster. Some, like me, got trained by Nixon and will be skeptical and jaded for life. Let me see if I can copy this Swami inspired descriptive emoticon. It will test to see if other generated emoticons turn into question marks.

It works . Just copy them in from another word processing app.

. Just copy them in from another word processing app.

I'm on a tablet, and these things appear to have different rules than do old fashioned desktop and laptop computers.

In other words: I'M OLD!

Oy…

HEY, YOU! GEDAHELLOFFMYLAWN!!!!!

WAAAAAAAAAH!!!!!!!!

I'M TOO OLD TO DO NEW TRICKS!

Or TURN new tricks, for that matter…..

Let me try a different one:

?

A few more:

??????

Well I went through our last three years taxes and the wife and I paid a rate 1.8% less than we did the two previous years. Our refund is smaller but we did get a tax cut. We lost most of our charitable deductions and also lost most of the state and local deducts, I'm not sure but I think next year we lose even more deductions so we'll see? Can't be good for charities though, we don't give just to get a tax break (we'll take it) but I'm sure many people do?

Well

. We tried but nothing gained but a good

. We tried but nothing gained but a good

.

.

'Mueller's Found A Coven' In So-Called Witch Hunt, Ex-DOJ Official Says